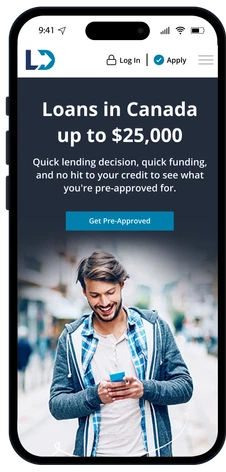

Loans in Canada

up to $25,000

Quick lending decision, quick funding, and no hit to your credit to see what you're pre-approved for.§

Get Pre-ApprovedPersonal Loans to Fit Your Goals

Whether you apply online for a Line of Credit or at a branch for a Secured Loan, you'll find out exactly what you qualify for with no impact to your credit score.§

Loan

Protection

Optional Loan Protection could help cover your loan when unexpected life changes or lifetime milestones happen.‡

15 Minute

Funding

Receive your money quickly! You could get your funds in as little as 15 minutes with Interac e- Transfer®.

Account

Management

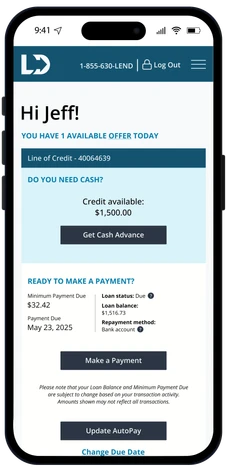

Make payments online or on the LendDirect mobile app.

Line of Credit

Online, By Phone, At a Branch- checkmark

Up to $10,000

- checkmark

Borrow what you need, pay only for what you use

- checkmark

Apply once and access available credit anytime, anywhere

- checkmark

Get pre-approved with no impact to your credit score§

Secured Loan

At a Branch- checkmark

Up to $25,000

- checkmark

Secure your loan with your vehicle

- checkmark

May qualify for more than a Line of Credit

- checkmark

Help build your credit†

- checkmark

Get pre-approved in a branch with no impact to your credit score§

The LendDirect Application Process

Your path to loan funds made simple through LendDirect.

1

Apply Your Way

Apply online, by phone, or at a branch.

Secured Loans are only available at a branch.

2

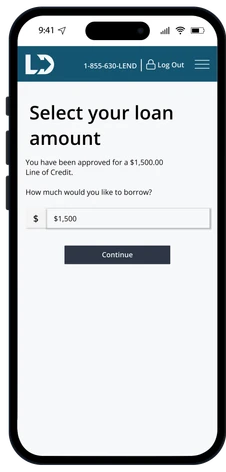

Submit Your Information

Provide the required documents. Get a quick lending decision and review the documentation. Once approved, sign your loan agreement.

3

Get Your Money

Use Interac e-Transfer® electronic funding or direct deposit to your bank account.

4

Manage Your Account

Easily keep track of your account online (or in our LendDirect mobile app)!

Why Borrow with LendDirect?

LendDirect has proudly offered safe and secure personal loans in Canada since 2016. Constantly evolving, we've embraced change to ensure our Customers get the best loans and service we can provide. You're welcome to choose how to apply with us online, by phone, or at a branch.

Everyone enjoys a classic, and the Line of Credit is a favorite. Apply, and once approved, you never need to apply again to access your available credit. Quickly borrow as little or as much as you'd like up to your approved limit. Your payment will be returned to your available credit amount, so you can continue to borrow. Plus, you only pay interest on what you use.

Interested in a Secured Loan? We offer those too! But we do ask that you visit us at a branch. Bring the required documentation and your vehicle that will be secured to the loan. Once approved, you may qualify for more money than our Line of Credit. With a consistent payment schedule and a set loan term, you could be driving potential money. Get pre-approved in minutes for the available loans you qualify for in your area.§

Let's get started.

Get Pre-ApprovedCheck Out Our Reviews

Showing our 5 star reviews

Check Out Our Reviews

Want more answers? Check out our FAQs page.

LendDirect makes it simple to apply online, by phone, or at a branch, all with no obligation. You can even start your application online now. Just submit your personal and income information, and you'll receive a quick lending decision. Once approved, you could get your funds in as little as 15 minutes through Interac e-Transfer®, or easily have it direct deposited to your bank account.

To apply for a Line of Credit, you must be at least 18 years old and have the following:

- Valid ID

- Steady source of income

- Open chequing account

- Phone number

- Home address

LendDirect requires you to visit a branch to apply for a Secured Loan. Our process is still simple, however it is slightly different from a Line of Credit. A branch representative will need to look over the vehicle being secured to the loan along with additional documentation. Visit our Find a Branch page for a location near you!

To apply for a Secured Loan, you must be at least 18 years old and apply at a branch with the following:

- Ownership documentation

- Valid ID

- Steady source of income

- Open chequing account

- Phone number

- Home address

- Proof of insurance

- Vehicle onsite

Currently, Customers are not eligible to have these loans at the same time.

We're happy to help Customers with various credit scores. A credit score is just one of many factors we consider whenprocessing loan applications. Come into a LendDirect branchnear you to find out how we can help!

Yes, you can! With Interac e-Transfer®, your loan money can be safely and quickly deposited into your bank account. And for more convenience, you can set up automatic payments with the same speed and security.

What can Interac e-Transfer® do for you?

- Highly secure to keep your information safe.

- A flexible and time-saving way to make payments.

- Nearly immediate processing, often made in a few minutes.

The Optional Loan Protection Plan is an insurance product that may cover your loan payments and/or outstanding loan balance if you experience lifetime milestones or unexpected changes. Easy enrollment and most claim decisions are made within 72 hours based on the completed claims package being received by the insurer.

If you have questions, contact:

Equifax Canada Co.

National Consumer Relations

Box 190

Montreal, Quebec H1S 2Z2