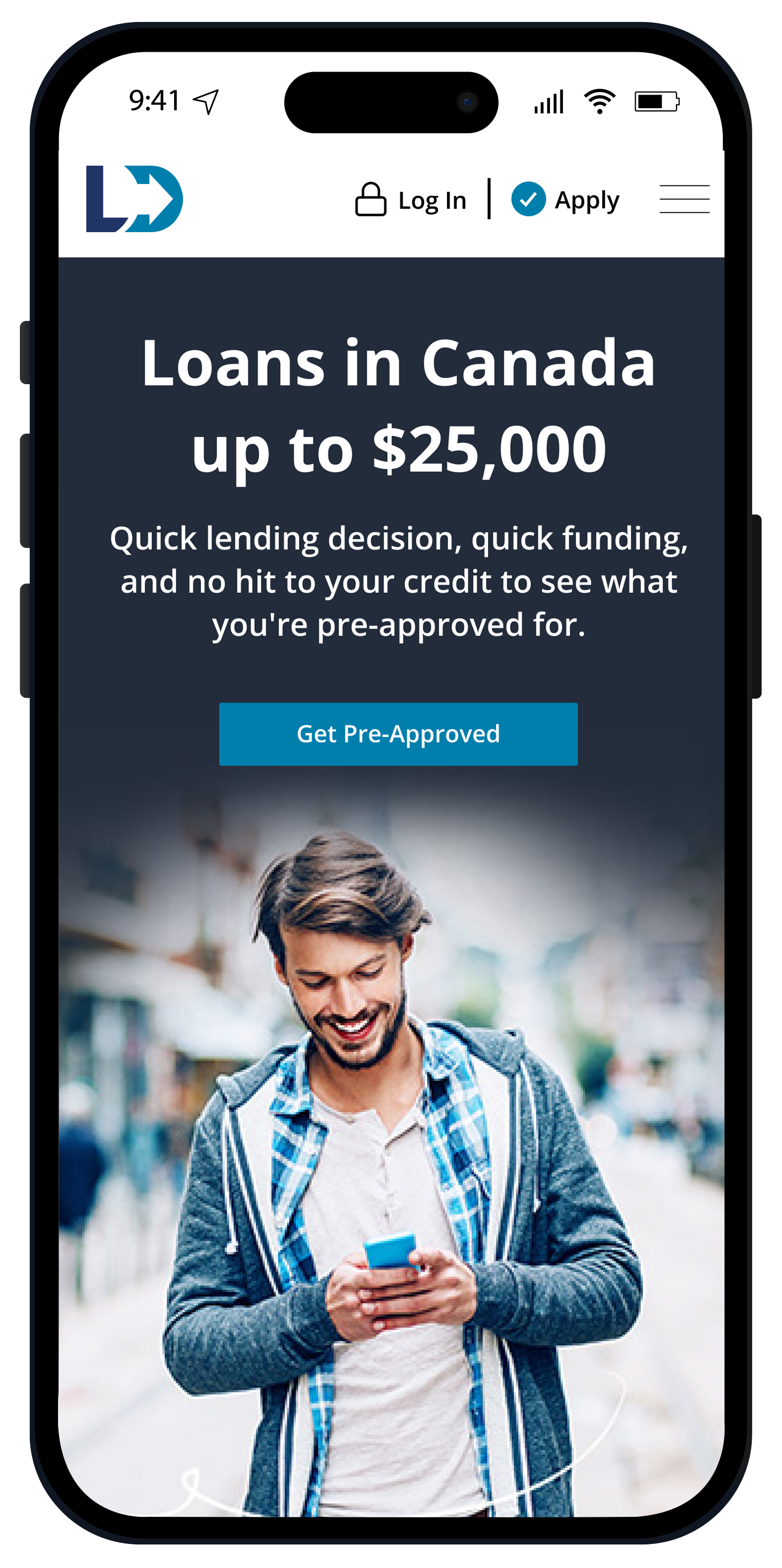

Welcome Cash Money Customers in BC, NL, NS, ON, & SK

Loans in Canada

up to $25,000

Quick lending decision, quick funding, and no hit to your credit to see what you're pre-approved for.§

Get Pre-ApprovedPersonal Loans to Fit your Goals

Whether you apply online for a Line of Credit or at a branch for a Secured Loan, you'll find out exactly what you qualify form with no impact to your credit score.§

Loan Protection

Optional Loan Protection could help cover your loan when unexpected life changes or lifetime milestones happen.

15 Minute Funding

Receive your money quickly! You could get your funds in as little as 15 minutes with interac e-Transfer®.

Account Management

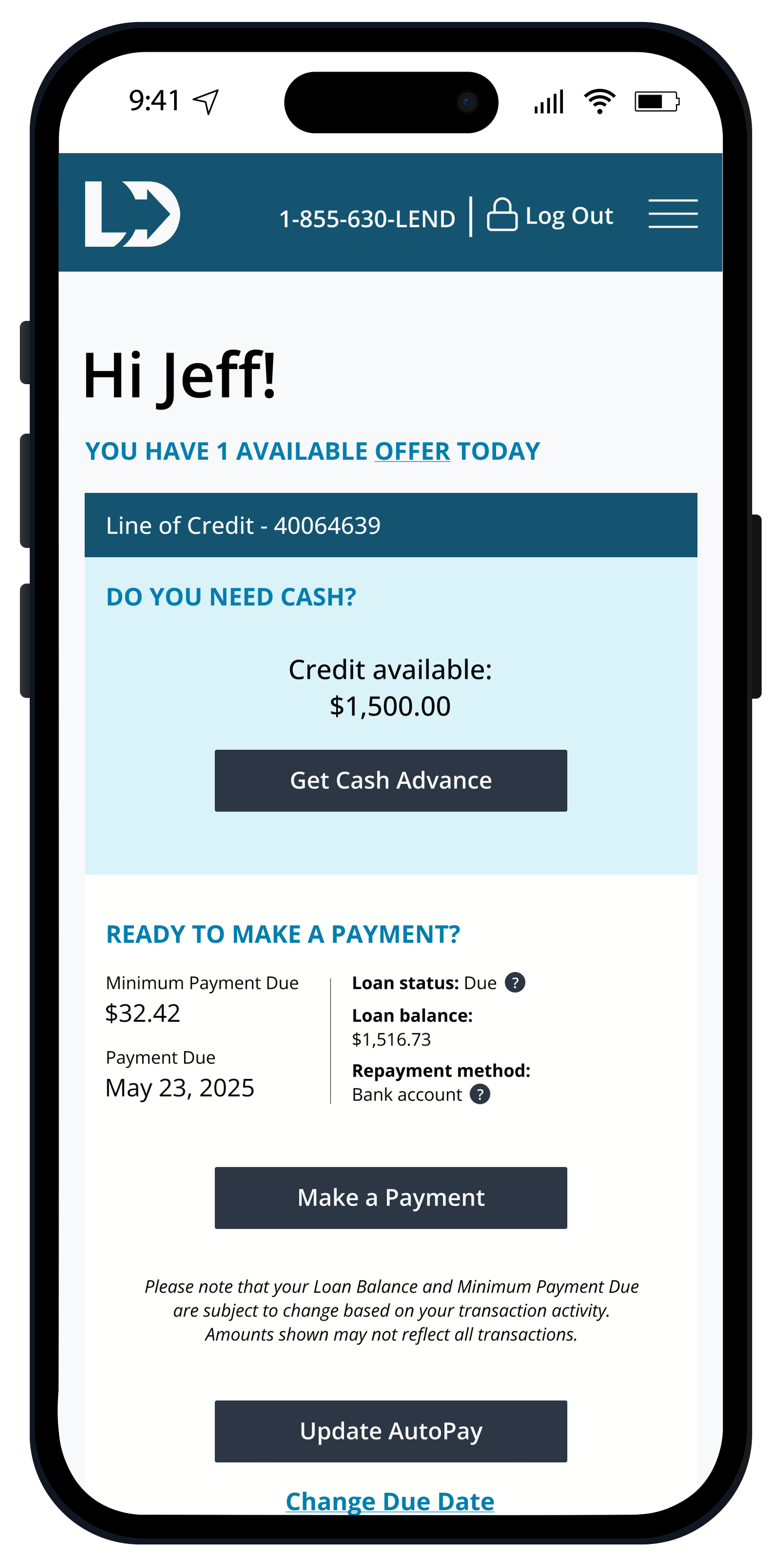

Make payments online or on the LendDirect mobile app.

Line of Credit

Online, By Phone, At a Branch

Up to $10,000

Borrow what you need, pay only for what you use

Apply once and access available credit anytime, anywhere

Get pre-approved with no impact to your credit score§

Get Pre-Approved

Learn More

Secured Loan

At a Branch

Up to $25,000

Secure your loan with your vehicle

May qualify for more than a Line of Credit

Help build your credit†

Get pre-approved in a branch with no impact to your credit score§

Find a Branch

Learn More

The LendDirect Application Process

Your path to loan funds made simple through LendDirect.

1

Apply Your Way

Apply online, by phone, or at a branch.

Secured Loans are only available at a branch.

2

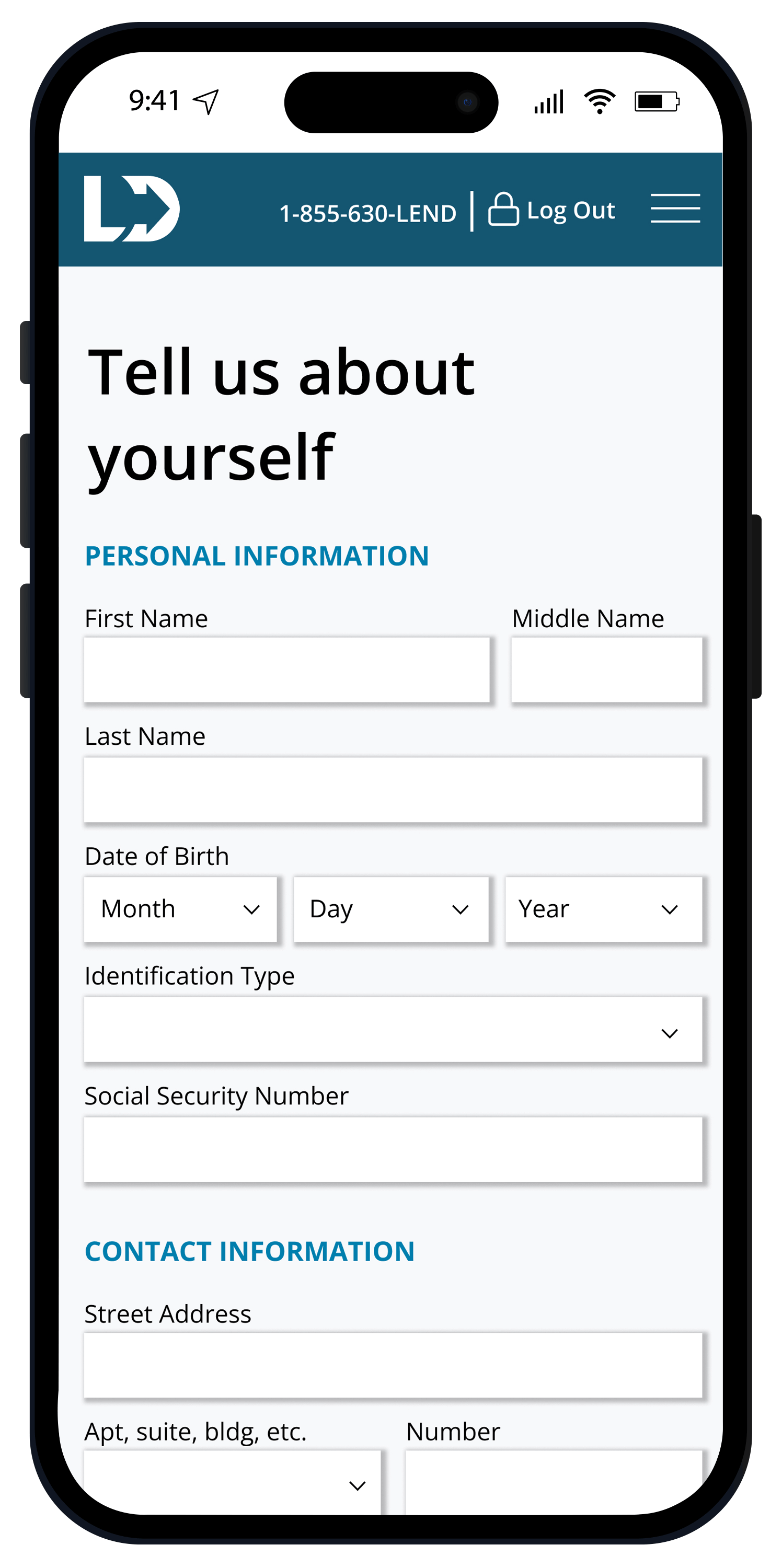

Submit Your Information

Provide the required documents. Get a quick lending decision and review the documentation. Once approved, sign your loan agreement.

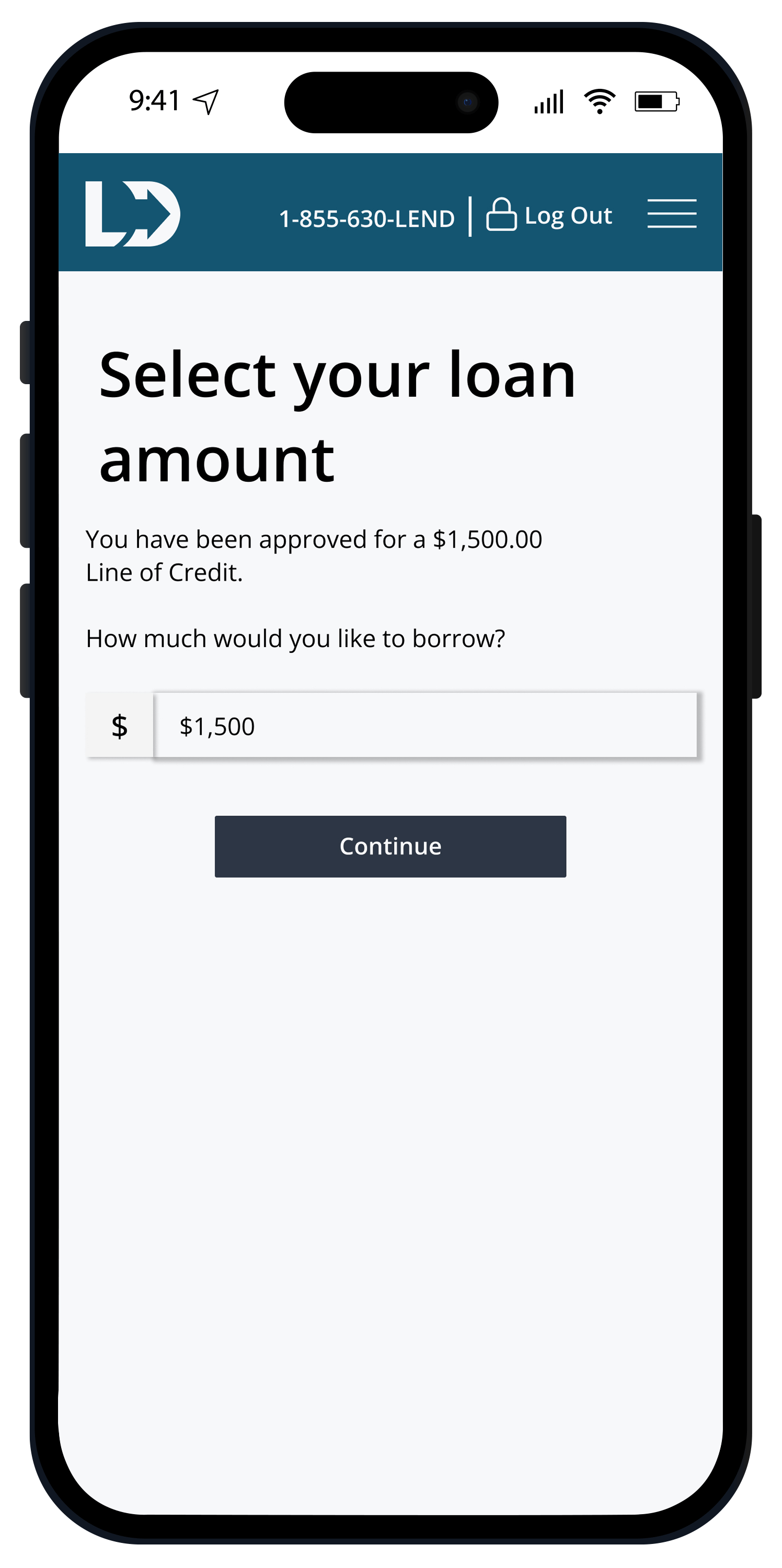

3

Get Your Money

Use Interac e-Transfer® electronic funding or direct deposit to your bank account.

4

Manage Your Account

Easily keep track of your account online (or in our LendDirect mobile app)!

Why Borrow with LendDirect?

LendDirect has proudly offered safe and secure personal loans in Canada since 2016. Constantly evolving, we've embraced change to ensure our Customers get the best loans and service we can provide. You're welcome to choose how to apply with us online, by phone, or at a branch.

Lets get's started.

LendDirect Blog: Stay in the Know

Check Out Our Reviews

Showing our 5 star reviews

Frequently Asked Questions

Want more answers? Check out our FAQs page.

To apply with LendDirect, you will need to be at least 18 years old and have the following:

- Valid ID

- Steady source of income

- Open chequing account

- Phone number

- Home address

You can apply for up to $10,000. Discover how much you are pre-approved for without affecting your credit score.§ Get pre-approved today!

- ID number

- Income information

- Open and active bank account, institution, and routing number

- Proof of income